how much tax is taken out of my paycheck in san francisco

The state tax year is also 12 months but it differs from state to state. October 6 2022 154 PM CBS San Francisco PIX Now SACRAMENTO -- Gov.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

- Answered by a verified Tax Professional.

. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. It can also be used to help fill steps 3 and 4 of a W-4 form. These are contributions that you make before any taxes are withheld from your paycheck.

Fast easy accurate payroll and tax so you can. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

1 day agoUpdated on. If you make 70000 a year living in the region of California USA you will be taxed 15111. For a single filer the first 9875 you earn is taxed at 10.

Some states follow the federal tax. Youll pay this state unemployment insurance tax on the first 7000 of each employees wages each yearup to 434 per employee in 2019. How old are you.

915 on portion of taxable income over 44470 up -to 89482. 505 on the first 44470 of taxable income. During the deferral period lasting through December 31.

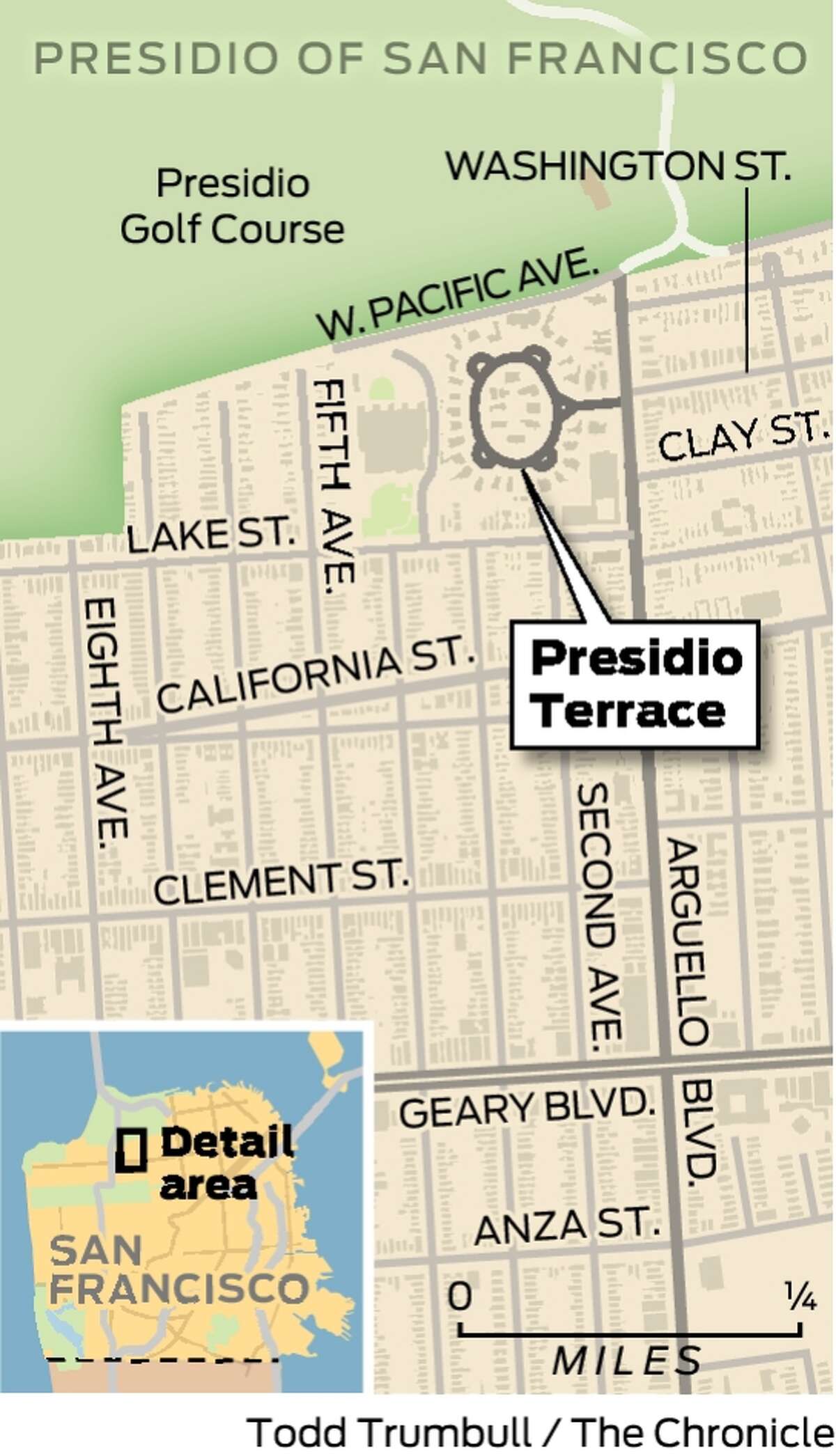

How much tax is taken off a paycheck in Ontario. Calculating your California state income tax is similar to the steps we listed on our Federal paycheck. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their.

Estimate how much taxes will be taken out of my paycheck. So the tax year 2022 will start from July 01 2021 to June 30 2022. Tax rate for nonresidents who work in San Francisco.

1 day agoThe refund which will either come as a direct deposit or a prepaid debit card may take up to January of 2023 to arrive. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

I would like the least amount of taxes taken out of my paycheck how to go about doing that. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the. The Governors office says payments will range from.

Only the very last 1475 you. Your average tax rate. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California.

Payroll Expense Tax. California unemployment insurance tax. Your average tax rate is 1198 and your marginal tax rate is 22.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Gavin Newsom on Thursday confirmed the state will begin sending out.

The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Your employer withholds a 62 Social Security tax. If you make 55000 a year living in the region of California USA you will be taxed 11676.

That means that your net pay will be 43324 per year or 3610 per month. Deduct retirement deduction from gross pay before calculating federal income tax if the plan is pretax. Normally 62 of an employees gross pay is taken out for this purpose and another 62 is paid by the employer.

This marginal tax rate means.

No More Deals San Francisco Considers Raising Taxes On Tech Wired

Why San Francisco Is In Trouble 19 000 Highly Compensated City Employees Earned 150 000 In Pay Perks

2022 Federal State Payroll Tax Rates For Employers

New Homeowners Pay Considerably More In Taxes Than Longtime Homeowners Voice Of San Diego

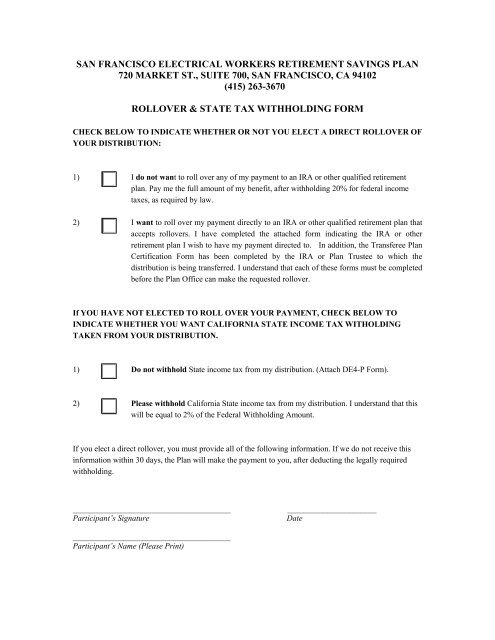

San Francisco Electrical Workers Retirement Savings Plan Eisb Org

California Paycheck Calculator Smartasset

San Francisco Voters Pass Overpaid Executive Tax

San Francisco Taxes Filings Due February 28 2022 Pwc

How To Calculate Net Pay Step By Step Example

Income Tax Hike To Fund Clean Air And Wildfire Programs Qualifies For California S November Ballot

Taxes On Stocks What You Have To Pay How To Pay Less Nerdwallet

Here S How Much Money You Take Home From A 75 000 Salary

Income Tax Florida How Much You Could Save Wtsp Com

Jose Cisneros Treasurersf Twitter

W 4 Form What It Is How To Fill It Out Nerdwallet

Jose Cisneros Treasurersf Twitter

Why Households Need 300 000 To Live A Middle Class Lifestyle

San Francisco S Tech Workers Are Leaving The Bay Area The New York Times